We are negotiating for the safe deposit box insurance for the customers and hope to get it before we open.

This insurance will include following offers

Through iSafeBoxes Rental’s collaboration with SDBIC, we can proudly provide safe and secure solutions to store your valuables against loss and damages. All items stored in the deposit box are covered from manmade or natural disasters and theft. With zero deductible, you do not have to pay a penny out of pocket when there is a loss.

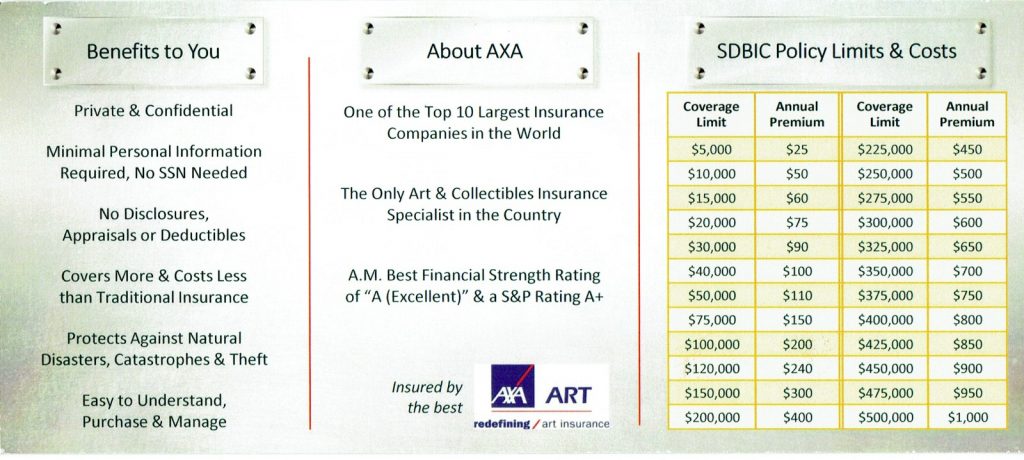

The ‘Safe Deposit Box Insurance Coverage, LLC’ (SDBIC) secures and protects your valuables while in ‘iSafeBoxes Rental’ deposit boxes. Their patented insurance provides customers the maximum insurance coverage at a low cost. SDBIC’s insurance coverage is offered in partnership with AXA ART, the world’s leading art and collectibles insurance specialist. SDBIC, a leader in secured vault insurance solutions and risk assessment, developed SecurePlus accreditation in response to the lack of recognized standards to assess the safety of contents stored at private vault facilities.

To become accredited, a facility undergoes a rigorous assessment of its physical design and operations. It involves the analysis and inquiries in over 200 different areas ranging from vault design and construction, physical and electronic security, access technology and controls, fire detection and suppression, institutional policy and procedures, and management oversight.

Safe deposit boxes are the safest way to store your valuables and assets. Property inside the safe deposit box is insured against loss, damage, or destruction caused by fire, flood, robbery, hurricane, tornado, burglary, landslide, mudslide, sinkhole, earthquake, volcano, avalanche, explosion, tidal wave, terrorist act, other natural and manmade disasters.

Safe deposit boxes remain the best option–both the safest and cheapest–for storing valuables. We offer complimentary $5,000 insurance per safe deposit box with coverage from natural and manmade disasters. Every occupied box will have minimum $5,000 insurance coverage for ensuring safety for our customers. Banks do not insure any contents kept in safe deposit boxes. Remember that, by law, FDIC insurance covers only bank accounts. Also, don’t expect the bank to reimburse you for theft of or damage to the contents of your safe deposit box.

The customers’ can buy additional insurance up to $500,000 per box by simply visiting SDBIC’s website and following their few easy steps. Additional insurance information is always confidential between the customer and SDBIC. You can get all information and the discounted insurance premium chart while enrolling.

We insist that all of our customers buy the appropriate insurance for their boxes. For higher coverage or more information, visit SDBIC.com or Call SDBIC at 844-426-9467.

Valuables that are passed down generations may well be worth much more now than when they were first purchased. Your grandfather’s watch or grandmother’s necklace purchased for a couple of hundred dollars could be worth thousands of dollars today. Keep those family heirloom jewelry pieces safe by registering for a safe deposit box and insurance. Items legally covered under SDBIC include: Gold, Currency, Bonds, Collectibles, Art, Coins, Stamps, Antiques, Heirlooms, Wills, Trusts, Titles, Passports, Photos, and more.

Feel secure when signing up with SDBIC. They maintain absolute confidentiality and privacy for all customers. The additional insurance purchase is confidential between the customer and SDBIC. SDBIC will not need your SSN, nor any appraisals, disclosures, declarations of your property to increase coverage, nor are deductibles paid upon any loss. Simply create your account with SDBIC and follow their 5 steps. You will have a policy issued directly in your name. Confidentiality and privacy are preserved as disclosure of the contents of the box are not required to be insured.

SDBIC has made the sign-up process as simple, fast, and transparent as possible. It takes about 5 minutes and requires minimal personal information. No upfront disclosure or appraisals are required.

Step 1: Find your state and iSafe vault location. Enter the last two digits of your box.

Step 2: Choose who the insured will be (you and/or partner). Enter the date you want coverage to become effective. Select the amount of coverage.

Step 3: Enter minimal personal information and create an online account.

Step 4: Enter billing information. Confirm all is correct. Click submit.

Step 5: Receive policy and declaration pages via email or mail. Policy becomes effective the very next day.

There are other easy ways to sign up with SDBIC.

- Online: obtain a quote by filling out a quick form on their site: https://safedepositboxinsurance.com/

- Phone: Call their toll-free line 844-426-9467

- In-Person: At iSafeBoxes Rental, we’ll give you the information needed to set up coverage with SDBIC

- Mail: download their printable enrollment form and mail it to SDBIC at:

SDBIC, PO Box 724, Elgin, IL 60121

- $5,000 insurance included

- All-risk coverage built-in

- Increase it to $1 million and more at discounted rates

- Covers cash, gold, gems, art and more

- Confidential

- No forms to fill out

iSafeBoxes Rental offers $5,000 complimentary liability coverage to all our new client’s leasing safety deposit boxes (for the first year only) provided by Safe Deposit Box Insurance Coverage, LLC. You can choose to insure your box up to $1 million for an extra cost. While we work our best to protect your valuables, you are also guaranteed that your valuables are safe and insured against all kinds of catastrophes — fire, flooding, burglary, and even terrorist attacks.

Misconceptions about

Safe Deposit Boxes

SDBIC makes this process so simple. Protect and secure your valuable items in our safety deposit boxes without having to disclose the contents of your box. You can even extend the coverage to include your other properties with no intrinsic market value such as wills, titles, deeds, trusts, passports, digital backups, and photos.

In every transaction you make with us, you are guaranteed with full confidentiality and privacy and with zero deductible. Catastrophes and events that are covered by the insurance includes:

- Robbery

- Fire

- Flood

- Earthquake

- Tornado

- Tsunami

- Hurricane

- Sinkhole

- Terrorist attack

- Burglary

- Wildfire

- Looting

- others