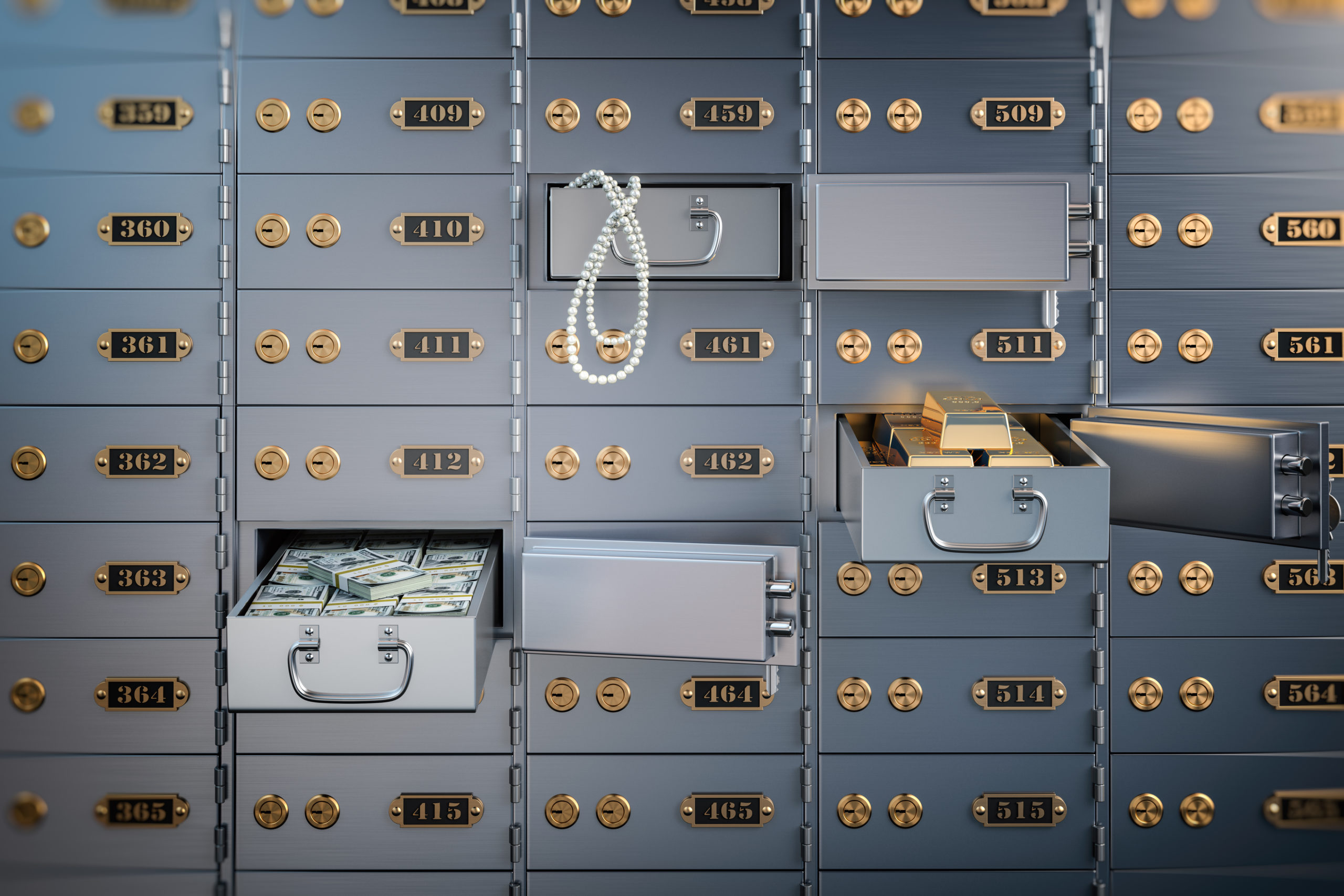

When you have a valuable item, you want to keep it somewhere safe and protected, right? It can be jewelry with high value, an heirloom, or even bonds and titles and certificates of your property. These things are at risk of theft and could invite unwanted guests into your home. Because you can’t bring these items with you all the time or guard it 24/7, it is important that you keep it in a place where it is protected even when you are not looking. One of the best ways to store these valuables is to rent a safe deposit box.

What is a safe deposit box?

A safe deposit box is something you can rent at your local bank, or you can choose to install it in your home. A safety deposit box is designed with specific safety measurements such as alarms and sensors to ensure that whatever you put inside will be protected and safe against the threat of theft. You can put your valuable items inside, including your important documents, almost impossible to replace or prized possessions such as a family heirloom.

However, it is not recommended to store equally important documents that you might use in case of an emergency, such as passports and power of attorney documents. Keep them a safe place – somewhere secure, but you can access them anytime you need them. Anyway, these documents are not “valuable and attractive” to intruders, so they don’t need to be kept inside your safe deposit box.

Are safe deposit boxes safe?

Safe deposit boxes are popular because they provide security and protection to your valuables as they have strict procedures and are designed to eliminate access against unwanted guests. Advanced alarm systems and sensors are placed, so your valuables are safe and sound. In fact, some safe deposit boxes may require a fingerprint before you can open it. Generally, safe deposit boxes are safe.

However, if you are using safe deposit boxes or planning to, you need to know that banks don’t provide insurance for the contents inside your safe deposit boxes. It could mean one thing – when there is a break-in inside the bank or inside your home, the items stolen inside your safe deposit box is not insured at all which means you can say goodbye to your lost items forever, plus you won’t be getting compensated for it at all. This is the reason why it is important to get insurance for your safe deposit box.

Having insurance for your safe deposit box means the contents inside are insured against theft and a full range of perils. To make sure you’re covered against it, get insurance first and insure your valuables. You should also take a photo of what’s inside your safe deposit box and regularly keep an inventory of the stored items. That way, you can have a list of your valuables and check what is missing during a misfortune. You store your valuables inside your safe deposit box, so it is only right that you insured it – so you are protected, especially in times when you need it the most.